Take Charge of Your Personal Financial PlanningPlan

Comprehensive modern Canadian financial planning software for Canadian DIY investors and advisors alike.

✓ Run any scenarios you like, anytime.

✓ Share financial plans with your personal or professional advisor.

✓ View and compare scenario details with simple grids and clear charts.

✓ Get information on your key financial planning questions.

✓ Retirement drawdown planning.

✓ Cash flow visualization.

features

Accounts

Employment Expenses Carrying Costs Non-Registered Loan Investments TFSA, FHSA RESP RRSP, RRIF DCPP, LIRA, LIF Annuities Defined Benefit Pension Mortgages, Loans, LOC Property Other Real Assets (cars, etc) CPP/QPP, OAS, GISFeatures

Employer bonuses,matchingPeriodic purchases

Charitable Donations Medical Expenses Margin balances Pension splitting Gifts and inheritances CPP/QPP tax credits and CPP2 deductions CPP and CPP2 benefits OAS benefits GIS benefits Tax calculations Itemized tax credits and debits RESP grants Education expenses Property purchases/sales/renovations Property tax deferral Inflating and depreciating assets RRSP Home Buyer Plan and repayment Rental property income and expenses Prescribed,(Non-P) and registered annuities Annuity purchases Net Worth and estate calculations

Rules

Joint Account flexibility on deposit/withdrawal How to save any surplus Repay loans Sell assets to cover expenses Sell assets for registered contributions Minimum Income, to tax plan Personal and Spousal contributions Keep personal and spousal balanced Save to a maximum amount in an account Ensure you can keep a minimum balance Prioritized & flexible rulesWhat If? Any scenario, Any time

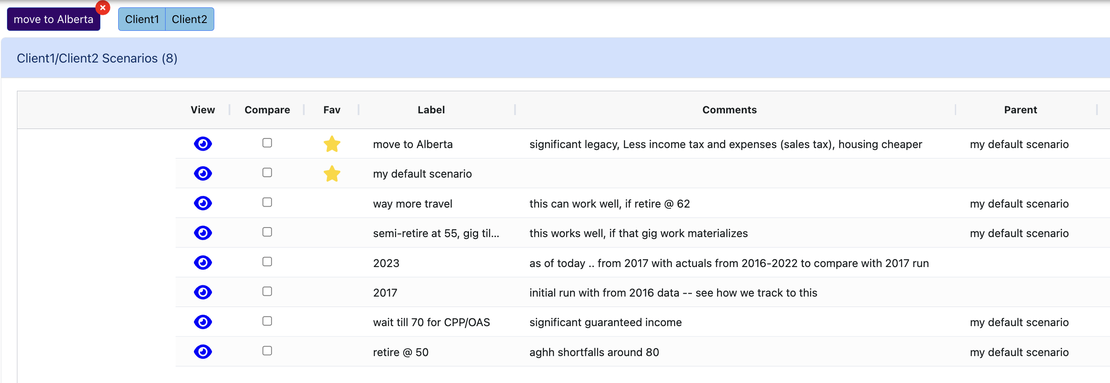

Create as many scenarios as you want, when you want, you don’t have to wait for someone to run them for you. Create a variety of scenarios that reflect how your circumstances change or may change. Copy from one scenario, make a few changes and quickly observe the results and note what the effect of that change is and save the ones that are useful for future review. Run scenarios from the first years of data entry and either use actual values from the start till this year or you can let it calculate all values as it would have originally would have from the original year.

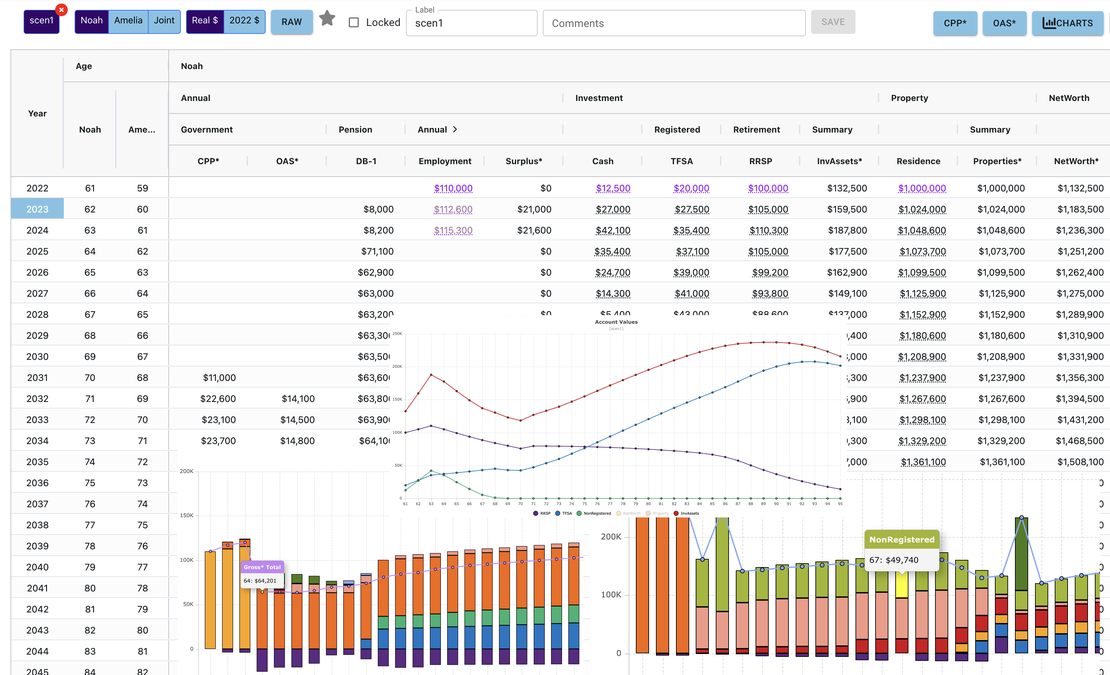

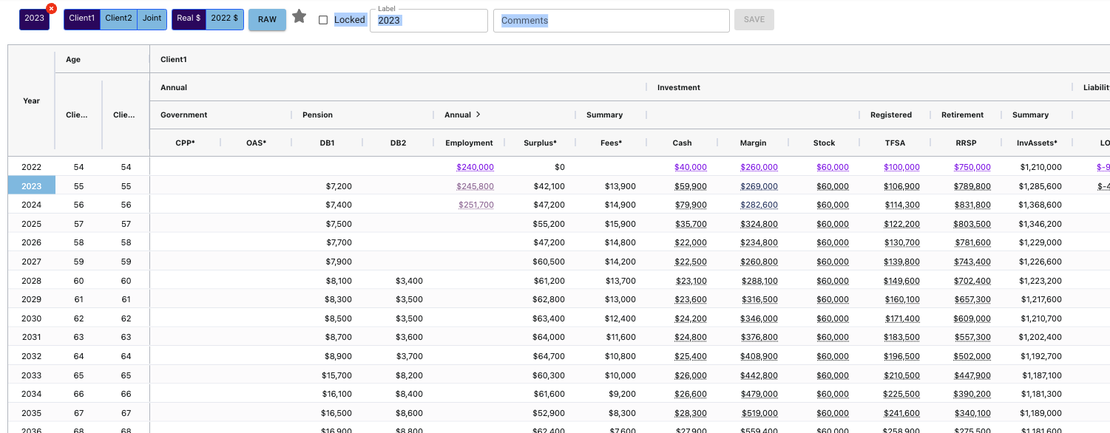

Complete personal financial plan on a single pane of glass

Quickly see how all accounts/values change over time on a single grid. Edit directly from the grid and quickly re-run the scenario. Certain values are colour coded so you can see at a glance what values were input vs calculated, and which values indicate a shortfall problem in the scenario. Expand columns on the grid to get more detailed data on their sub-components, or collapse them to get a overall picture. All grids have multiple views for each partner and combined as well as inflated (Real$) or current dollars.

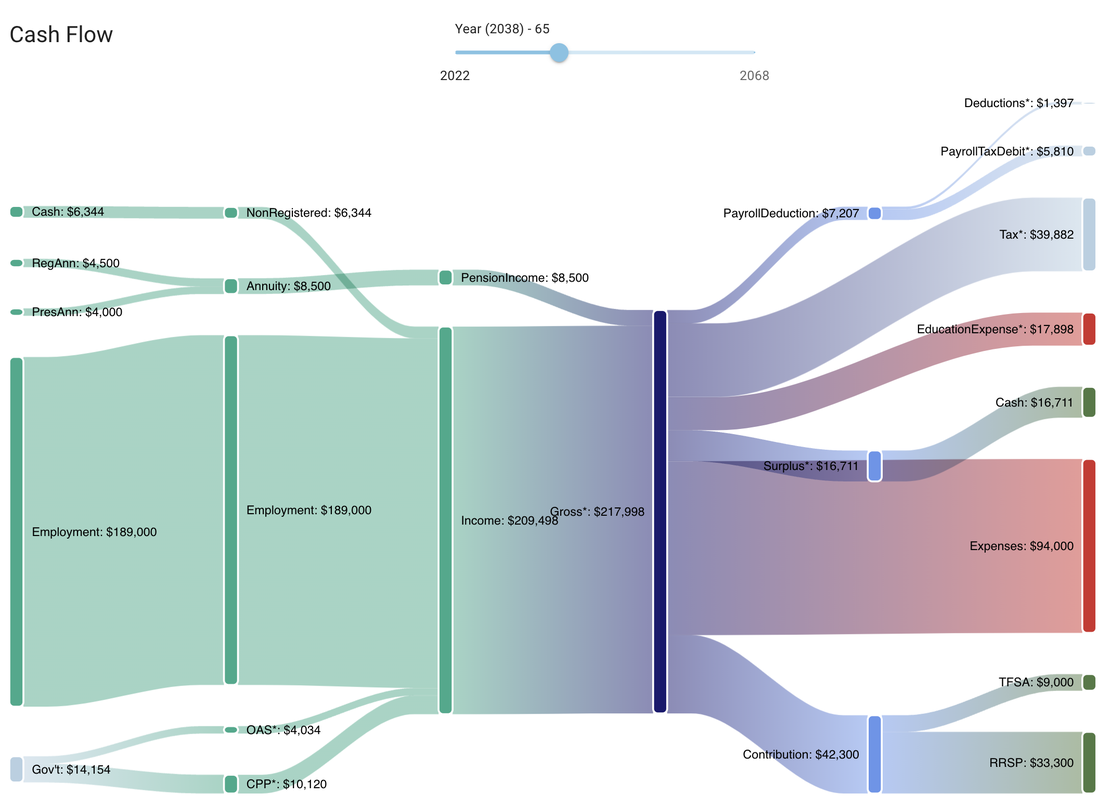

Cash Flow with Sankey diagram

For each year, visualize the incoming and outgoing cash flows. How much income comes in from each source, and how it is classified. It then shows how that Gross income is distributed between expenses, taxes and savings among others.

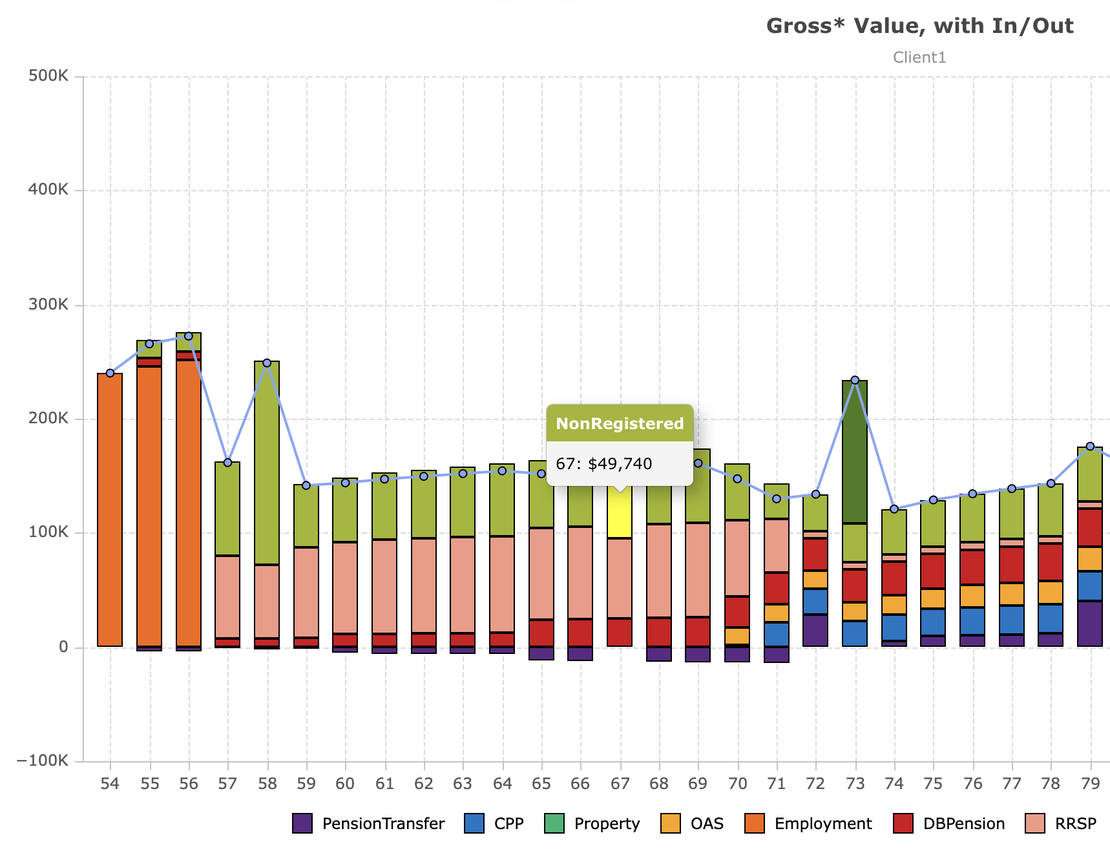

Chart any account

Chart any account, or account type over time. View incoming and outgoing values into each of the accounts. Quickly see where is my Income coming from? what types of Investment returns make up that value. View investment accounts, liabilities, properties, taxes and others. Have multiple accounts or account types on the same chart. Create new charts that meet your needs. All charts have multiple views for each partner and combined as well as inflated (Real$) or current dollars.

Compare any scenario

View 2 scenarios in grid or chart form on the same screen. Compare any cell, or totals. Chart comparisons between scenarios. See how those scenarios change any given account, taxes, or benefits. CompareCompare scenarios that you have run years before with scenarios you have now based on actual values for the interim years to see how you are tracking to a previous plan. Run any chart side by side between two scenarios or use the special comparison charts which can plot them each account from the two scenarios on the same chart or a comparison chart which for each account subtracts (scenario A - scenario B).

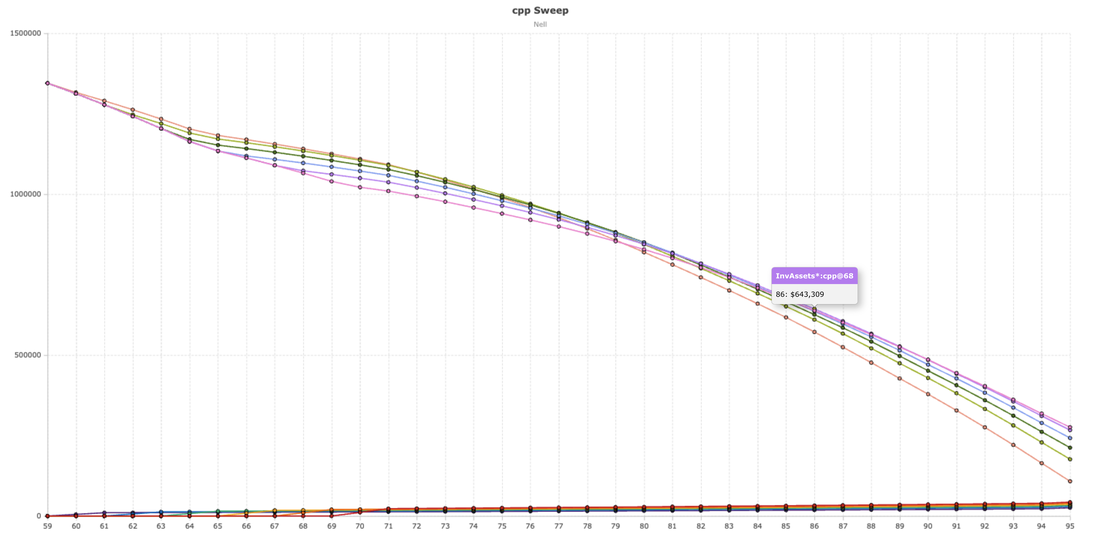

See how key changes impact your plan

Sweeps allow you to get insight about the key questions you might ask and how changing one variable impacts your plan. Current sweeps include when to take CPP (& OAS), how much can I spend, and when can I stop working. Chart any accounts or types of accounts for each iteration of the scenario.

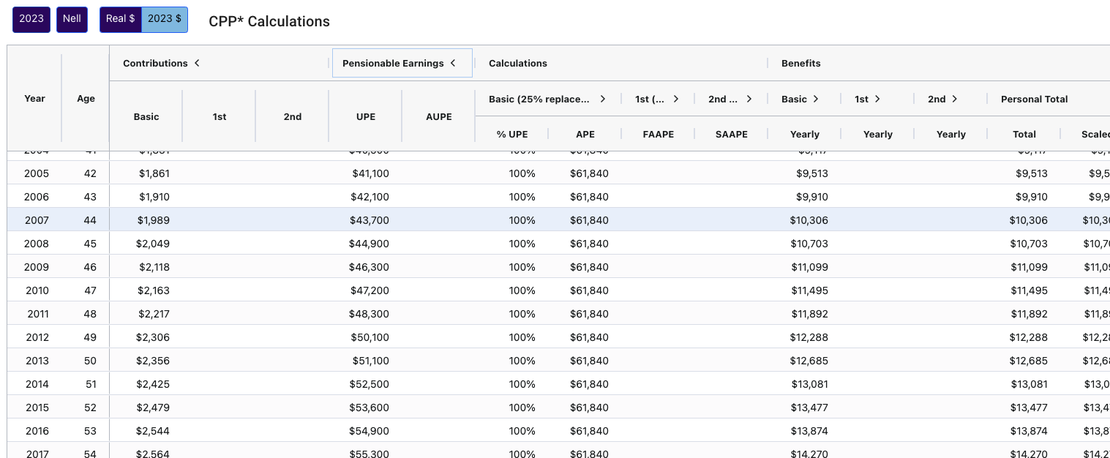

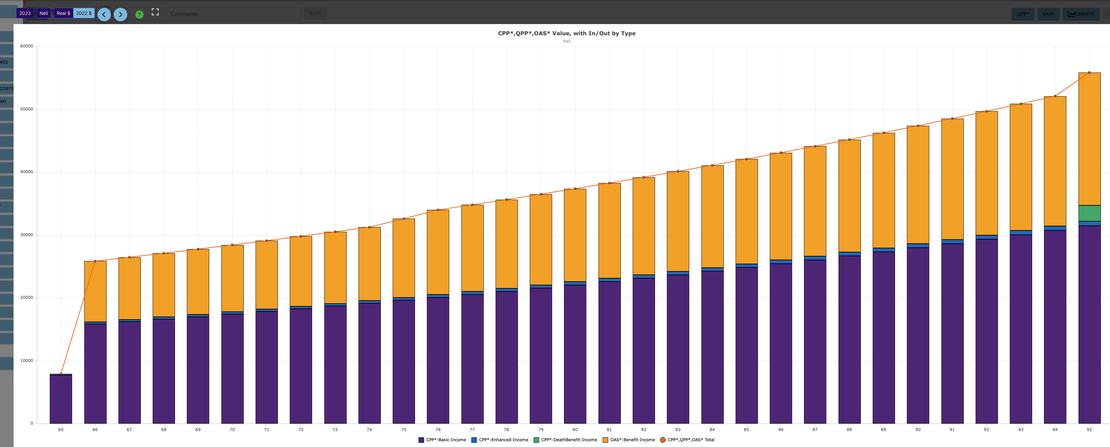

Understand the impact of government benefits

CPP/QPP, OAS and other benefits create a backbone of most Canadians retirement plan. MyOwnFP has a detailed view of how these are calculated for your situation. You can understand how they may impact your ability to fund your retirement plans.

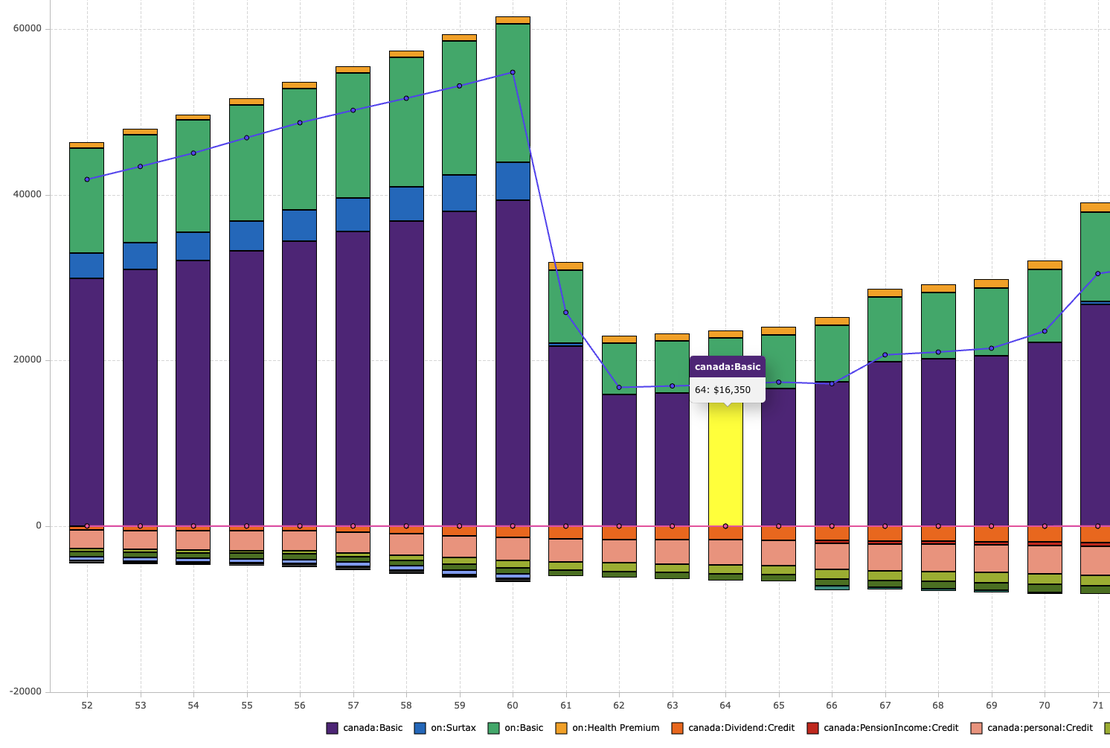

Tax Effects

Taxes are sadly part of our life, and as you create a financial plan its important to understand how taxes impact your plan. You can change your rules to attempt to even out your taxes over time, or create a plan which has minimal taxes. MyOwnFP has Canadian federal, provincial and territories tax tables for various debits and credits. You can understand which deductions, credits and taxes impact your situation which are shown clearly on the tax charts. Chart your overall and marginal tax rates.

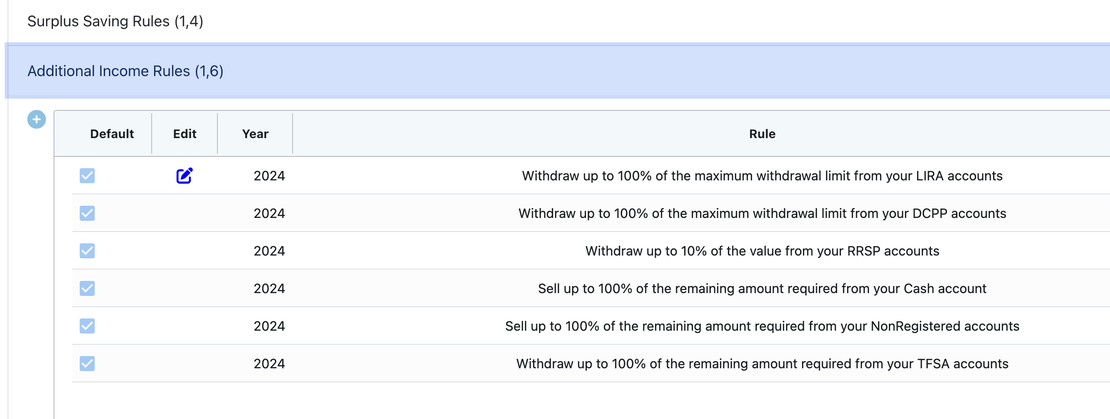

Rules to manage your financial planning priorities.

Rules are the movement of money between accounts that you want. Save a bit, pay some extra on your mortgage, allocate extra to your TFSA or RRSP, or create a withdrawal plan to minimize tax. Saving Rules allow you to alter what types of savings you wish to do each year, and how to fund those savings. Income Rules allow you to determine where you should take income from in which years, both to cover expenses and to allow you to alter tax planning.

choose your plan

standard

- 5 Clients

- Unlimited Scenarios

- All basic account types

- All charting

- Scenario Comparisons

- Sweep runs

- Flexible saving and income rules

- Yearly tax calculations

- CPP(QPP)/OAS calculations